If you’re in the FinTech space, this article will show you how to generate 10-15 qualified leads per week using nothing but LinkedIn.

In this article, we have decided to share a recent case study of work we have done for a fintech firm called RegAlytics.

Because of our help, they were able to land a big 6 figure deal after working with us for 6 months.

We will discuss how we generated 118 in 8 weeks and even share some replies that we got from prospects during our generation campaigns.

Why would we do this?

Well, we would like other Fintech companies to see how we can help them generate the same high-quality leads in a matter of weeks.

So if you have been struggling to find qualified leads for your business in the fintech space, this article is for you.

(Feel free to use some of the pointers mentioned in your own lead generation strategy, or let’s hop on a call and get you those leads. Our work on Regalytics has led to several large signed deals. )

RegAlytics: Who they are and what they do

RegAlytics provides accurate, clean, vetted, daily regulatory data from US regulators that is enriched by regulatory experts and delivered in the most flexible format available. Because of this, they save their clients hours of sifting through complex and confusing regulatory announcements.

Mary Kopczynski, the CEO of RegAlytics is recognized as one of the leading financial regulatory crisis gurus, having advised some of the world’s largest global investment banks in regulatory change management.

Besides this, she has been featured on TV, in various articles on the internet, and has also been published in Forbes Magazine.

NOTE: When a company is well known, or when a CEO/founder is well known in the industry, it really helps with generating new leads.

Why?

Because if a company has a good reputation, a great track record, accolades, and accomplishments to back them up, then potential customers are going to trust them.

This is what happened with Mary and RegAlytics, because she was so well known in the industry and had such an incredible track record with years of experience, and accomplishments behind her name, it just propelled our marketing campaign forward in a really positive way (metrics to come).

This is certainly one strong aspect that accounts for our success during these outreach campaigns.

Why RegAlytics hired Salesbread

A bit of background..

The story of how RegAlytics hired us is quite an interesting one.

Their salesperson was an avid listener to our podcast. When their salesperson resigned, they told RegAlytics to call Salesbread.

Why? Because she knew from the podcast that Salesbread had the right strategy for booking more qualified leads.

Mary then hopped on a call with us and fast forward 13 months later, we are still working together.

Back to the story…

RegAlytics was looking to sell specific fintech data, and they hired us to help them do so.

Their AI tool helps companies, like fortune 500 companies, and smaller fintech startups stay updated on regulatory issues.

Their ideal target audience was investors and CEOs in the fintech industry.

The campaign was very industry-specific, therefore when prospects received messaging they knew that Mary had a true grasp of what they were dealing with.

The outreach was very specific to the prospect’s world, so to speak, therefore accounting for the ongoing success of these campaigns.

Our fintech lead generation strategy

Step 1: Build a list of prospects

The first thing that we needed to do was build a list of founders, CEO’s and investors in the fintech space.

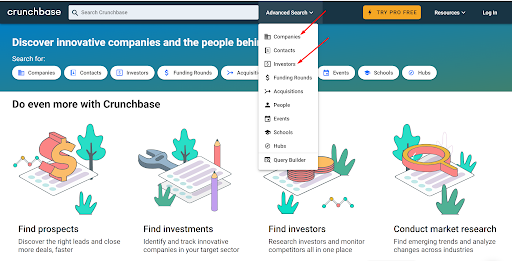

At the beginning of this outreach campaign, we used Crunchbase to find the relevant companies that RegAnylitics wanted to target.

Once we found them, we used Linkedin Sales Navigator to find the right people at those companies to target.

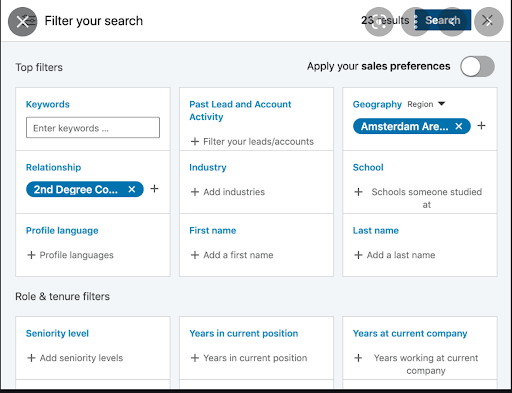

Step 2: Filter by Mary’s second-degree network on Linkedin

The next step in the process was to filter this list through Mary’s second-degree network on Linkedin and only connect with those who had a mutual connection with Mary.

Why do we do this?

Because there is a shared connection, people are more likely to accept your connection request message, thus increasing the campaign’s acceptance rates.

PRO TIP: If you want to go after fintech leads, be sure to use Linkedin filters so that you are ONLY reaching out to people who are active on the platform.

If you find prospects who aren’t active on Linkedin, add them to an email campaign.

Step 3: Connect with the right prospects via Linkedin

Once we had the right list of people to target, we then sent them connection request messages;

These messages were personalized and included something industry-related. We also mentioned a shared connection and that we would like to connect with them.

The result?

Out of 1005 connection requests sent, 444 connected.

This gives us a connection rate of 44.2%

Connection Requests Sent

Prospects Who Connected

%

Connection Rate

Step 4: Once connected, we followed up 3 times and asked for a meeting.

Finally, we wrote ultra-personalized messages for each prospect who connected with us. It took about 5 – 10 min to research each person so that we could write a message specifically for them.

Personalization is so important in these campaigns because it makes the prospect stop and think.

It breaks the pattern of just deleting or ignoring a message.

Why?

Because when you mention something about the prospect in your message, it makes them curious.

It’s also important to always ask for a call or a meeting in these messages. In fact, in our first touch message, we asked the prospect what would work for them for a call.

Did this work?

Have a look at our stats.

We contacted 303 people, and out of this 29.3% responded to our messages

Number of Prospects Contacted

%

Positive Reply Rate

To break it down:

For every 100 prospects contacted in our campaign, when you take into account those who need to accept the connection request, and then see the follow-up messages, we were able to get a 12.9% reply rate, from cold prospect to reply.

See some of the replies we received:

1. Hi Mary, your timing is great. Any chance you are free for an intro call this week? I am open Wed. morning from 8am-11am PT. If it works for you send over an invite @ (email address and name)

2. Sure Mary, how about a 30-minute meet and greet. Let me know when might work for you over the next week or two and I will shoot over a Zoom.

Thanks,

3. Mary, glad to connect! What made you curious about us? We provide watchlist screening, and our data is better, more user friendly, and less expensive than equivalent from (company name) and other legacy firms.

We’re 1.5 years as a startup and are currently focusing on finalizing our initial slate of products and moving to sell/grow mode.

I’d definitely like to learn about your experience as a tech founder in NYC. I’m beginning to set up after-shots coffees for this summer, I’m back in June. Also happy to do zoom if you’re more comfortable online.

Best,

4. Hi Mary,

It would be great to have a chat. Easiest way to schedule would be through email so send me on at (email address) with a calendar link to review OR I can send you one once I have your email.

Look forward to speaking

5. Hey Mary, it was great to video chat with you the other day. I would like to talk further about integration. Let’s take this to email. (email address)

6. Perfect, I’m sure we can find some time that week. How about 6/15 at 2 EST? Let me know, and I’ll send out an invite.

7. Hi Mary, catching up on LinkedIn messages and I’d be happy to chat. I’ll send you an email for an intro call. I appreciate you reaching out.

8. This works as well as email for me, I’ve just been pretty busy the last few days and fell behind on responding. I am enjoying my role at (Company name).

This is week 3 for me, and I am being introduced to the fintech space through this role, so I don’t have much of a perspective on the related regulations yet.

My other company, (Name) has nothing to do with fintech. It is more in the social/entertainment/video game industry.

9. sounds great. let me know what works

10. 10 am Tuesday PST 🙂 Sent invite – chat then

Why the success and great replies? Here are our top tips:

When it comes to B2B lead generation there are a few things that you should consider before reaching out.

Think about:

- What’s in your message – (Do you have relevant content?)

- How long is your message or cold email?

- Do you have a clear CTA?

- Have you done enough research for in-depth personalization?

- What’s your segmentation like? (Is it spammy, or well-spaced?)

- Do you sound pushy and salesy in your messaging? Or are you more interested in the prospect and their pain points?

Tip 1: Keep your messages short

In both our connector message and follow-up messages, we made sure that they were short. There were less than 50 characters. Why?

Think about it. When you receive a long email from a stranger, do you read it? Most probably not.

People don’t have time in their busy lives to read essays. So keep your messages short when reaching out to decision-makers.

Tip 2: Don’t be a pushy salesperson

One of the fastest ways to put a prospect off you is by pushing your sale. DO NOT DO THIS.

Salesbread always follows the 90/10 rule. What does this mean? It means talking about yourself only 10% of the time for context and talking about the prospect 90% of the time.

Never sell in your messages, but rather wait for the call/meeting to discuss how you can help the prospect with their pain points.

Tip 3: Use personalization

The problem with some marketers is that they take a list of people, add them to an email marketing campaign, and send automated messages to everyone on that list.

Oftentimes, the message is the same. People know when a bot is reaching out to them, and because there is so much spam messaging out there, all prospects will do is hit delete, or ignore the message.

This is why personalization is so important. Yes, it does take time. Yes, it might seem tedious. BUT it’s the only way that you will get a prospect to notice your message.

Why?

Adding in something about the prospect creates a “pattern interrupt.” – This means that the potential customer notices something out of the ordinary from their usual messages.

If you receive a message and it says:

“Hey, I really enjoyed your webinar on XYZ, would love to connect and hear more.”

or

“Your post on social media marketing was really interesting, I liked XYZ. Would love to connect and hear more about your digital marketing expertise.”

If you send personalized messages, the chances of the prospect responding will definitely be higher. This will help you get your foot in the door for further discussions.

Tip 4: Be careful with your segmentation

Another mistake that some people make is to send messages or emails daily. (worst case, a few in 1 day.) Check your cadence. If you are sending messages one after another, it comes across as spammy.

Wait 3 days before sending your first follow-up message, and then another 3 days before sending your next. This enhances the user experience and doesn’t make you look pushy.

(For more info on perfect cadence, click here)

Tip 5: Have a clear CTA

A clear CTA lets the reader know what you would like them to do. So if you are after a meeting, ask the prospect to book a meeting in your calendar link, or even better, ask them if you can schedule a quick meeting in your calendar for a time and day that suits them.

Here are some examples:

- Are you available for a 20-minute chat on [MONTH] [DAY] at [HOUR] [TIMEZONE]?

- How about a quick 30 min call next {{=day}} at 4 pm [TIMEZONE] to discuss more?

- What will it take to get 25 minutes on your calendar next week?

- Can I steal you away for a 15-minute phone call tomorrow at 5 pm [TIMEZONE]?

- Let’s catch up for 15 mins. Just select any date and time on my calendar link.

Ready to get more qualified leads in your sales funnel?

If you are a fintech startup, or a veteran financial service provider, and would like more qualified leads for your business, let’s get on a call.

If inbound and content marketing is just not cutting yet, outbound might be the way to go.

118 leads in 8 weeks could also be yours, but you need to use the right account-based marketing firm. And this is where Salesbread comes in.

We offer cost-effective solutions that guarantee 1 lead a day.

All you need to do is get in touch.