Lead generation for financial services isn’t always the easiest; It really depends on WHO you are selling to.

If you are selling to large financial institutions, you’re going to be reaching out to multiple decision-makers at your target accounts.

You need to think about this carefully; especially with regards to who you should reach out to first.

Besides this, you might want to consider different types of lead generation strategies to find quality leads at these financial companies.

This could range from search engine optimization to LinkedIn outreach, content marketing, and PPC.

Keep reading to find out about strategies that we have found helpful at Salesbread; As well as other lead-generation tactics that work for selling to financial institutions.

(Salesbread is known as the lead per day agency. We managed to generate 118 Leads In 8 Weeks for a fintech company called RegAlytics. If you would like the same results, hop on a free strategy session with us.)

Think about this first when targeting financial professionals

Something that we have found helpful, as lead gen experts, is doing both a top-bound approach first; This means trying to get the end decision maker so that they can refer you to the department that’s going to consider your proposal.

If that doesn’t work, you should then consider the “bottom-up” approach; This is where you reach out to employees at the bank who would be using your service, fintech, or product so that they can help you earn a meeting with the rest of the bank.

Another thing to think about is, if you are in the financial services space, you probably have certain partners that could help you get a referral into these large financial institutions.

Think about the companies that are already working with the banks that you are trying to break into, and how you can develop a partnership with them, to speed up the sales process.

We recommend using all approaches because trying to sell to financial service providers is complicated.

You need as many entry points as possible to do this right and effectively.

Really understand who your buying customers are

This is probably one of the most important first steps when it comes to selling your product/service.

You need to understand who your ideal prospects are.

Think about which companies or platforms you would like to sell to, such as:

- Cryptocurrency

- Crowdfunding platforms

- Consumer and savings banks

- Brokerage and trading firms

- Online lenders and fintech companies

- Digital payment processors and money transmitters

Also, think about who you would like to target:

- Compliance Experts

- Chief Risk Officers

- CFOs

- COOs

- Managing directors and founders of fintech start-ups

Or would you rather reach out to employees who could get you in with someone higher up?

We suggest looking at your current buyers’ data.

- Which financial industry has bought from you?

- What do these industries have in common?

- Who was the decision maker?

Do you have potential partners that can refer you to the bank or companies that you’re selling your services to?

If you can find common patterns between your buyers, it’s easier to create look-alike lists for your outreach campaigns.

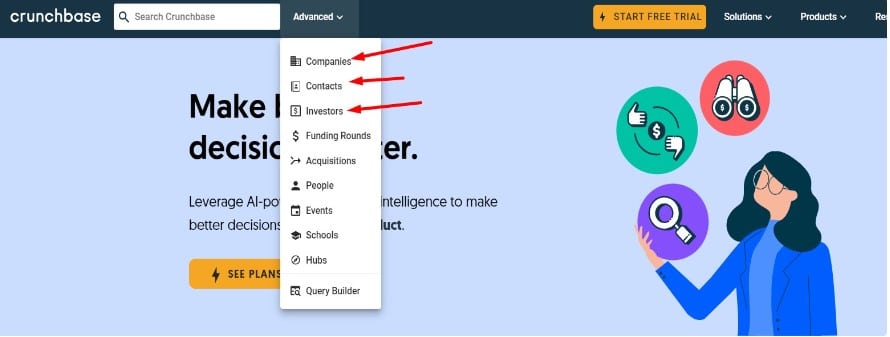

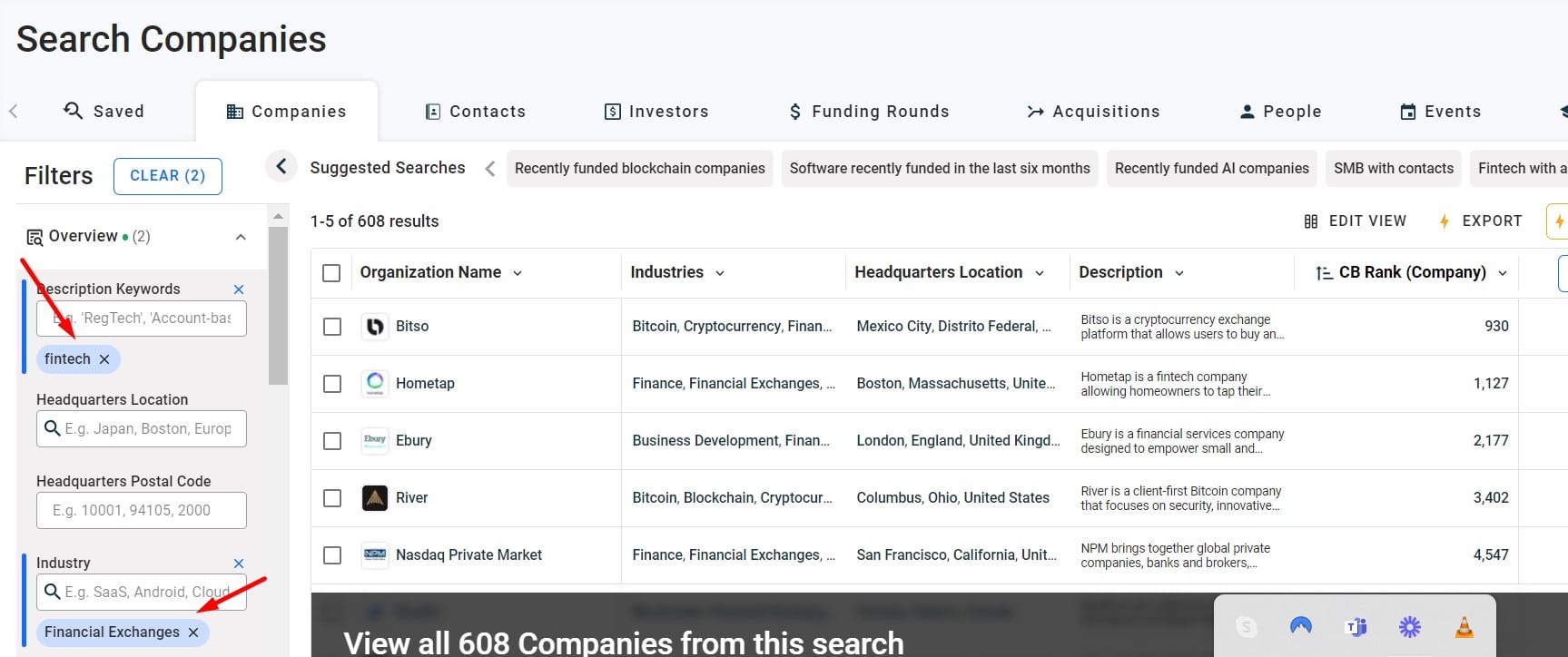

You can use tools such as Crunchbase to help you build a list of businesses you would like to target. You can use it to filter specific keywords, locations, industries, and even funding rounds.

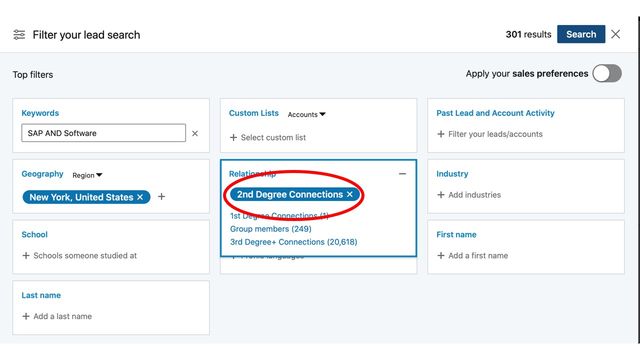

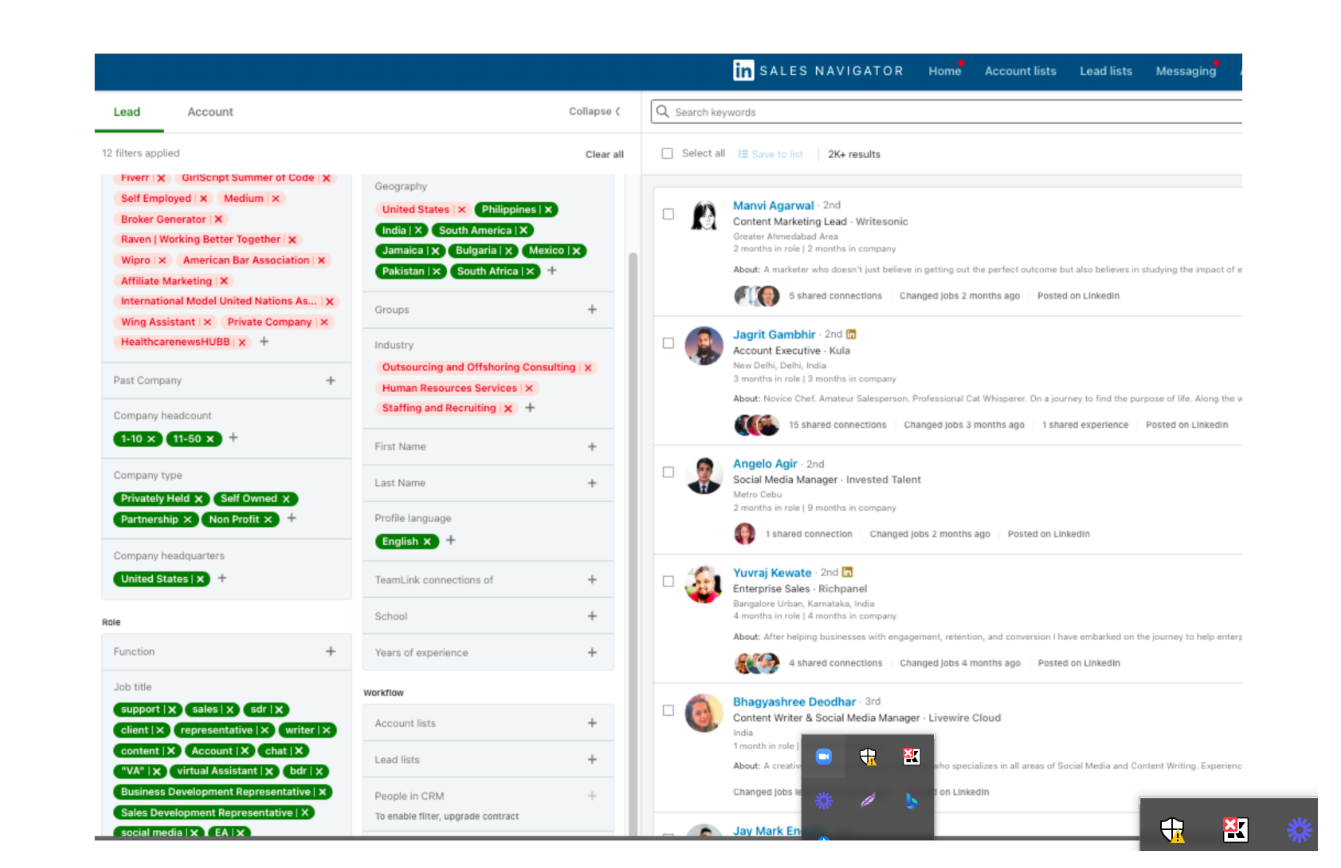

Once you know which companies you would like to reach out to, we suggest using LinkedIn Sales Navigator to find the right people at these companies.

For example, plug this list into LinkedIn’s Sales Navigator and then filter by “title”.

Be sure to include the words CEO, CFO, COOs.

You can get quite specific about titles in this filter.

Next, also filter your list by your second-degree network;

Why?

Because stats have shown us that when there are mutual connections people are more likely to accept your message request.

PRO TIP:

If you want to go after fintech leads, be sure to also filter your list by recently posted.

This ensures that when you send a connection request message, you’re sending it to potential customers who are active on the platform.

1. Use LinkedIn outreach

We still recommend using LinkedIn to reach out to potential leads, because what we have found is that banks have their internal firewalls set to drastically reduce the number of external emails that reach their teams.

For example, here are two case studies where we used LinkedIn to find financial leads for our clients.

In both cases, we reached out to decision-makers who were high up in the corporate ladder in the financial services sector.

In one case we managed to generate 118 qualified leads in 8 weeks, as well as 85 qualified leads who booked meetings in 8 weeks for our second client.

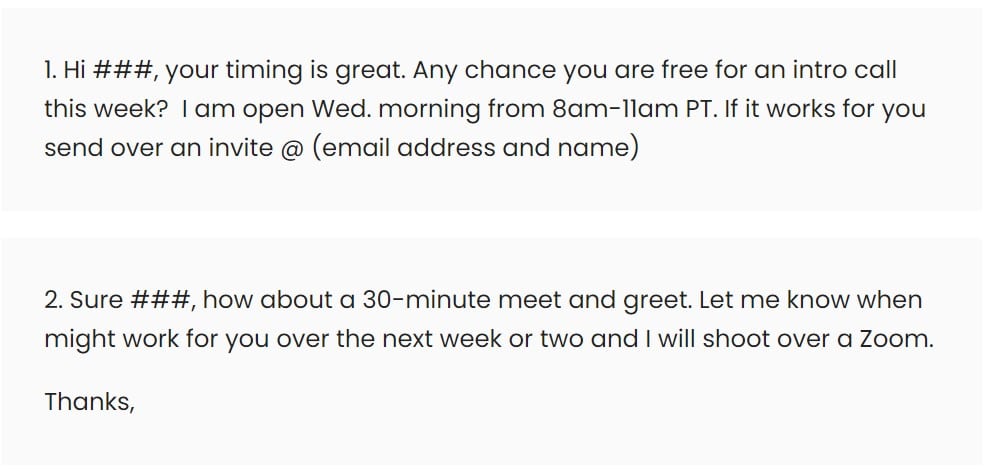

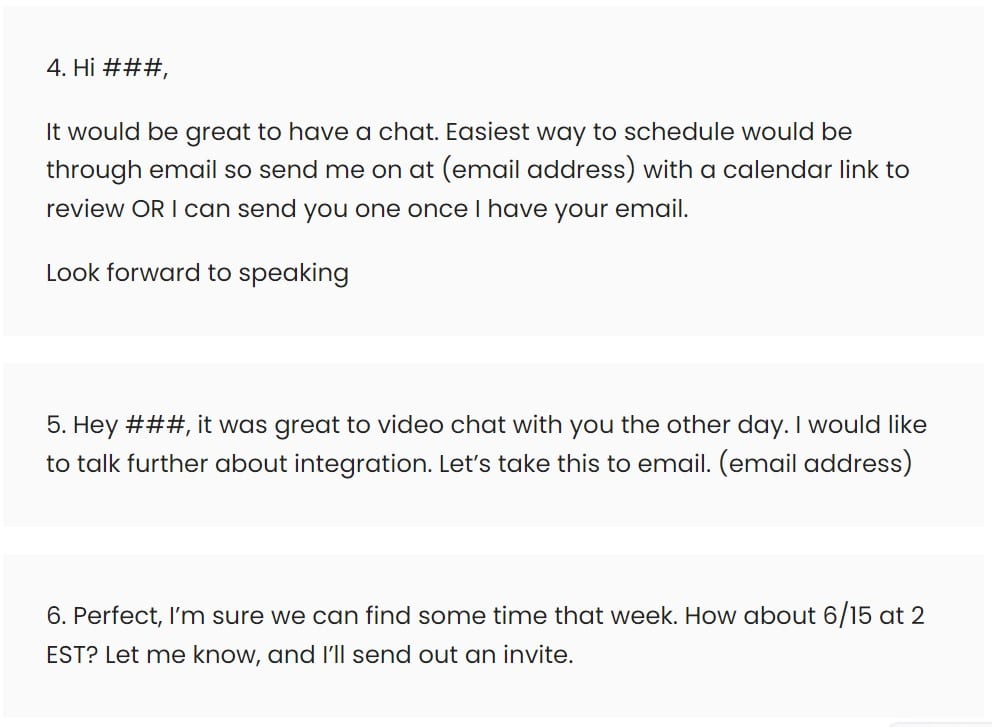

These were some of the replies we received from individuals with such titles such as Chief data officer, Head of Data and Analytics, Founder, Managing director, and data science director:

Tips for LinkedIn Outreach

Write personalized outreach messages

According to SmarterHQ, 72% of consumers say they only engage with personalized messaging.

So if you aren’t sending personalized connection requests and follow-ups on LinkedIn your lead-generation efforts are going to fail.

Personalization sets you apart from every other spammy message on the platform.

Research each prospect on your list and find something very specific about them to mention in your message.

You could either compliment them on something, mention a commonality, or ask them a question.

Here’s an example:

“Rory, I enjoyed the article you wrote on the top 10 fastest growing fintech’s in the banking industry. Do you mind if we connect?”

Or

“Michaela, I noticed that you are in the crypto space, how’s your company dealing with {{current pain point?}}. I’m asking because my company does {{solution}} and we have noticed that many other crypto companies struggle with this issue. Would love to connect and discuss if you think this might be of interest.”

If your messages are personalized you will capture the attention of your readers, this is especially important if you want to get replies from CFOs, CEOs and founders in the finance space.

Follow up and ask for a meeting

Next, follow up consistently. Just because a potential client hasn’t responded immediately, doesn’t mean that they wont.

We suggest following up every 3 days, between 3 – 5 times.

If the prospect doesn’t reply, you could then add them to an email outreach campaign, or try reach out to them via a phone call.

It’s also important to have a clear call to action. We suggest asking for a quick booked call.

Make it as easy as possible for your prospect to respond.

Here’s some examples:

-

If this resonates with you, can we hop on a quick call?

-

Please send me your calendar link, and I will book a slot

-

How about a quick call to discuss {{pain point}} next week {{time and date}}.

-

What’s the best way to schedule 5 minutes to talk?

(If you’re looking for lead generation for financial services, we would love to help you. Hop on a free 15 minute strategy session with us here.)

2. Make use of content marketing

Content marketing compromises of a variety of strategies that can range from posting helpful content on social media, writing educational blog posts, using SEO to optimise your website and landing pages, as well as creating podcasts and webinars.

According to LSA Global, between 75% and 90% of financial services searches start online.

If you don’t have an online presence for your brand, you’re missing out on a number of leads who might be looking for what you’re selling.

As we mentioned above, if youre looking to sell to finance services, you need to pull out all the stops; Don’t just rely on one form of marketing.

Inbound tactics, along with outbound are sure to lead you to success.

When it comes to content marketing, do the following:

Identify Your Target Audience

This is still step number one. It doesn’t matter whether your using inbound or outbound methods, you HAVE to know and understand your ICP.

So as we mentioned above, think about who your current clients are.

What do they have in common?

You can then segment your audience based on their specific needs, for example high-net-worth individuals to everyday consumers, to tailor your content strategy accordingly.

Develop Valuable Content

With so much information out there, you want to develop specific helpful content for your target market. If you can share helpful tips or strategies that you have come across in your industry, share it.

Creating a trustworthy, “thought leader” online presence is one of the ways in which you can increase conversions.

For example, if you know that your tool solves a specific pain point that credit grantors are experiencing, write about how your tool or stratgey can help.

This can include:

Educational Content:

Writing blog posts, whitepapers, and eBooks about financial planning, investment strategies, retirement planning, and tax advice.

Case Studies:

Share your companies success stories and highlight how your services have benefited your clients. You can share stats, or strategies on how they increased their sales leads with your tool/service.

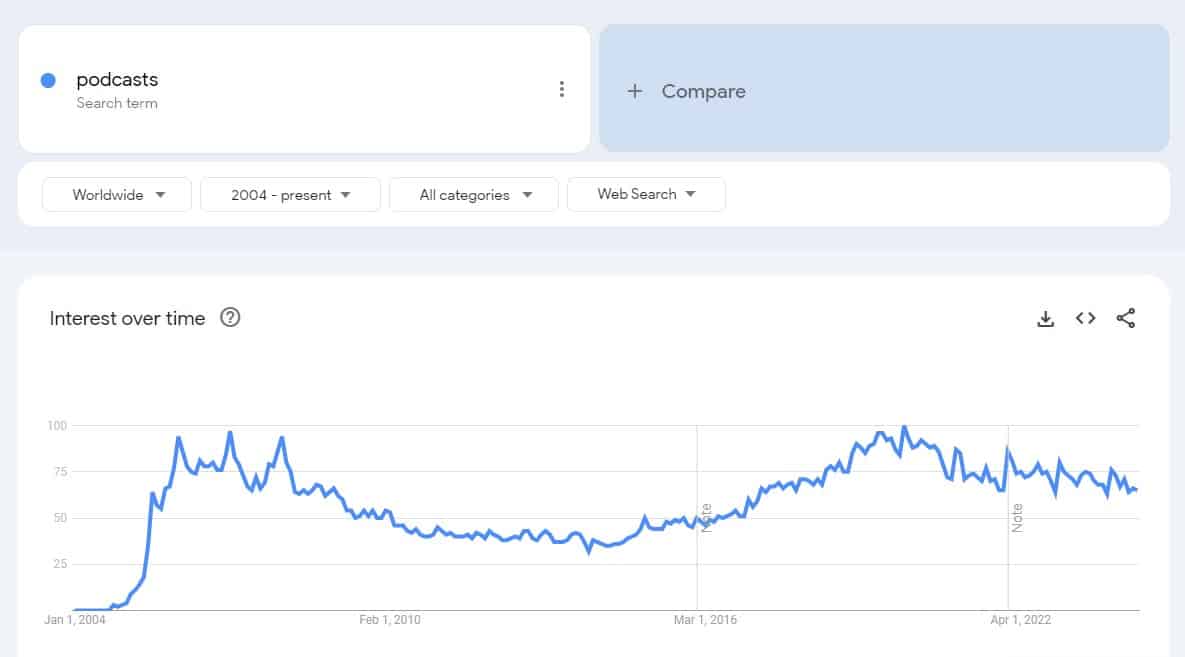

Podcasts:

Podcasting has taken the world by storm. Since 2004 you can see how search has increased for the term “podcast”. As of 2024, there are over 5 million podcasts available worldwide, with more than 70 million episodes between them. With over 464 million podcast listeners worldwide.

That’s a huge audience to tap into.

If you do decide to host a podcast, you could post your session on YouTube, Apple Podcasts, or even Listen Notes.

Be sure to host sessions with industry experts and discuss relevant financial topics. You can then share this content across social media platforms too.

The more you are viewed as an industry leader, the more opportunities you will get to sell your product or service.

Optimize your website for SEO.

Recently the world of SEO has been shaken up, but even if you are new to search engine optimization, you can still win sales leads.

Even relatively new sites can see results. Yes, it takes time to see results; but eventually, it does pay off.

When people are searching for specific services or tools, they normally use Google to find these solutions. If your pages are ranking on the first page of Google for specific intent-based keywords, people searching for your services will likely reach out to you.

Think about what people would Google if they were looking for my service or product.

If you’re selling money laundering detection and AML compliance, you might think of using the following keywords:

- Anti-money laundering services

- Money laundering detection software

- Money laundering software

You could then create blog posts for these keywords or landing pages; Be sure to use relevant keywords in your articles, as well as relevant internal and external links. (Try to earn quality backlinks from financial websites and industry publications.)

Try not to use AI to push out thousands of articles; Rather create unique pieces of content that has been written for humans and not Google.

If you can showcase the benefits of your software and share how it solves pain points, along with case studies and results, leads will come in organically.

Use Multiple Content Formats

Your content doesn’t have to stop at blog posts. Why not create videos, infographics, monthly newsletters, and social media posts for engagement? If you can keep your brand in the minds of potential customers, the chances of them converting will be higher.

Promote Your Content

Next, once you have created content, you want to ensure that it reaches your audience. Think about where your ideal clients spend most of their time.

This might be on LinkedIn for example, or Twitter. You can then engage with your audience when they comment on your posts.

You could also send your content out via email. Remember to use personalization and not spam prospects. The more helpful your content the better.

Be sure to include CTAs as well. For example, you could offer free demos, consults, eBooks, or templates. These lead magnets are a great way to attract new leads.

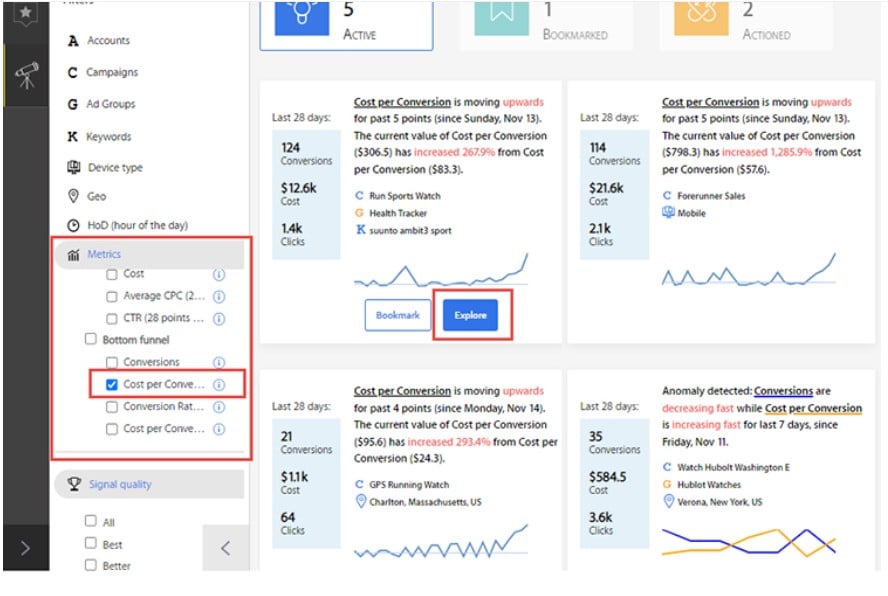

3. Use paid advertising

Paid advertising through Google Ads can help you reach a wider audience. With PPC you can target specific demographics, geographics, interests, and behaviors.

You can also tailor these ads to appeal to your ICP; For example to people who have shown interest in financial planning, investments, or advisory services.

Just a caveat here…

Ensure that you have budget control. Start small and scale up based on the performance of the ads. You can also set daily or monthly spending limits to avoid overspending.

4. Build Trust and Credibility

I think very few people hire an agency or use a service if they haven’t seen proof that it actually works.

It’s so important to establish yourself as a trustworthy authority in the financial services space. You can do this by showcasing:

- Recent testimonials and reviews

- Sharing any certifications or awards your company has received in the industry.

- Keep publishing and creating authoritative content across various platforms.

5. Hire lead generation services

If all of the above seems slightly intimidating, why not hire lead generation services that specialize in finding high-quality leads in the financial services space?

At Salesbread we have helped companies sell to financial institutions.

Some even received 85 qualified sales leads in as little as 8 weeks. We use ultra-refined list building along with expert personalization to reach out to your ideal target audience.

If you’re interested in learning more about our services, read this: The “1-Lead-Per-Day” LinkedIn Lead Generation Agency

… And hop on a free 15-minute strategy session with the founder of Salesbread.

Frequently asked questions

What is lead generation in financial services?

Lead generation in financial services is the process of attracting the interest of potential clients who might be interested in your financial products or services.

This could involve several different strategies, such as creating informative content like blogs or webinars, running targeted advertising campaigns, offering free consultations or financial assessments, and using social media to engage with potential clients.

You could use social media platforms such as LinkedIn, Instagram, or Twitter to generate leads for your company.

The goal is to gather contact information—like names, phone numbers, and email addresses—so you can follow up with these prospects and convert them into becoming actual clients.

How do you generate financial leads?

There are various ways in which you could generate leads, some of these strategies include:

- LinkedIn outreach

- Content marketing

- PPC

- Webinars

- Podcasts

- Social media marketing

How much do you pay for lead generation service?

It really depends on which form of marketing you choose. For example, if you decide to hire a content marketing agency you could pay between $6,000 a month to as high as $60,000+ a month for an enterprise business.

Whereas if you hire an outbound agency, you could pay between $3000 and $ 10,000 per month.

This article: What’s The Cost Of Hiring A LinkedIn Lead Generation Agency? – Goes into more detail on how much LinkedIn lead generation costs.

In conclusion

If your company is looking for effective strategies try out some of the above methods; LinkedIn outreach, paid advertising, content marketing, or podcasting.

But if you don’t have the time or experience to run a marketing strategy, hop on a free 15-minute strategy session with the founder of Salesbread.